Table of Content

You can travel out of town and stay away for as long as you want without hiring someone to house sit since the landlord is responsible for the property’s security. You also get to access amenities such as swimming pools and fitness gyms without paying an extra charge since the cost is rent inclusive. Even though searching for a vacant rental might take a bit of time, renting a house is a fast, simple, and straightforward process. You do not have to go through time-consuming processes like applying for mortgages and conducting home inspections.

Keep in mind that your monthly rent payment is likely to increase each time your lease is up for renewal. Depending on the housing market, you may end up paying more for rent than for a mortgage payment. A rent vs. buy calculator can help you evaluate which is best for your situation, but remember that it's only a rough estimate. One of the most important questions to consider when deciding between renting versus buying a home is your timeline. For example, if you’ve just moved to a city, expect a job change soon, or don’t plan to stay in the community long, it may make more sense to rent.

Flexibility

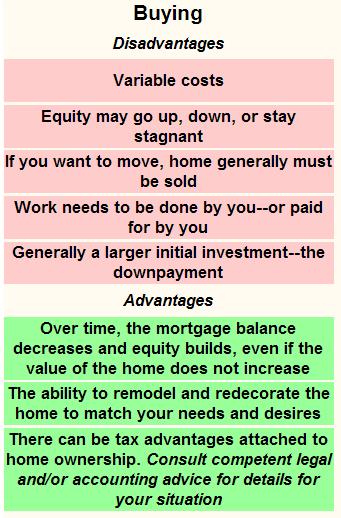

However, buying a home and renting one has some advantages and disadvantages and this is different depending on various localities. To make you understand which option is best for you, here are the pros and cons of buying versus renting a home. If you’re tired of pricy pet policies, limited decor options, and all the other community guidelines that renting entails, it might be time to buy a house. You may still have to deal with an HOA, but you’ll have a lot more freedom over decorations, landscaping, and your space in general. From upstairs neighbors who moonlight as professional cloggers to rent that rises faster than the living dead, rental life has some definite downsides. Everyone’s got their own reasons for becoming a homeowner, but we’ve rounded up five key disadvantages of renting that we’re betting you can relate to.

Third, if you put less than 20% down, you’ll generally have to pay private mortgage insurance on top of your monthly mortgage payment. PMI is insurance for the lender to protect them against you defaulting on the loan. PMI does nothing for you as the borrower, it just increases the amount that you pay each month. Buying a house typically costs between 15-30% of your annual income, depending on where you live. Maybe you aren't ready to settle down and don't want the commitment of owning property right now. Or perhaps you are looking for maximum flexibility when it comes to where you live or which amenities your home has.

How to Save for a House

Not only will you be adding more debt, but you don’t want to run the risk of not being able to pay your mortgage and losing your home. You are entering a site that is not operated by the credit union. Skyla cannot be held responsible for the alternate site's content, nor does Skyla represent either party should you enter into a transaction.

If you have consumer debt like credit card balances or personal loans, you should pay off that debt before buying a home. It would be great if you can pay off other debt like car loans and student loans before buying a home, but that’s not always possible. Interest rates and products are subject to change without notice and may or may not be available at the time of loan commitment or lock-in. Ultimately, when renting or buying a home you need to carefully weigh all of your options and do your research before making any final decisions.

Can A Home Loan Turn Into A Bad Debt?

If we want to paint the bathroom lime green and our bedroom hot pink, we can. If we want to turn the spare room into a yoga studio, craft center, or workshop, we can. But the reality is that owning a home is much more complicated than the freedom to wield a paintbrush or pick our own appliances. There are a lot of factors to consider when it comes to the advantages and disadvantages of owning a home - and how it stacks up compared to renting.

You can buy a property to rent out and rent a better property for you and your family to live in. In Australia there are taxation benefits that you can use to your advantage if you own an investment property. An investment property is a property that you own that you rent to someone else. The real effect of this is that the tax savings may be such that you can afford to rent a much better house than the one you can afford to buy. Homeownership is a long-term investment that can enable you to build wealth over time. That means treating your home as an investment and caring for it accordingly, with regular maintenance and repairs.

They will assess your personal situation and help you with clear advice. We will first discuss the advantages and disadvantages of renting a home. Renting an apartment is a good solution for many young people who want to live independently in their first apartment. Most of the time young people do not have a permanent job yet, and sometimes they are still studying and getting help from their parents with paying the monthly rent. Due to these circumstances, banks will not offer a mortgage. On the positive side, renting an apartment gives you more freedom.

Another disadvantage of renting a house or apartment is the lack of stability. You’re likely renewing your lease every 6-15 months, with an increase in rent each time. If you choose a fixed-rate mortgage, you can rely on having the same monthly payments until your mortgage is paid off or you refinance for a new rate and term. If you have a fixed-rate mortgage, you’ll also have peace of mind that your payments won’t go up every year—unlike renting a home where you may see annual rent increases. While your home’s property taxes and insurance may fluctuate, your principal and interest will remain the same for the full term of your home loan.

For example, platforms like Airbnb, renting a holiday apartment for long periods of time, or even exchanging homes with other owners in different locations. Homeownership brings intangible benefits, such as a sense of stability and pride of ownership, along with the tangible ones of tax deductions and equity. Majority of the time, tenants are only responsible for rent and utilities. You will not be responsible for property taxes, Loan and Interest Payments, insurance, and HOA fees . When it comes to renting, there are fewer responsibilities besides paying your monthly rent. Although it feels like money is being thrown out, there are upsides to renting.

Please note the site's privacy and security policies may differ from those of Skyla Credit Union. Ultimately, when buying a home or an apartment, you need to carefully weigh all of your options and do your research before making any final decisions. Not a lot of landlords offer a pet-friendly home for tenants. This could be due to the extra work like clean up that may be involved but it's possible if there are pet-friendly places for rent, the landlord may charge you more for rent. The landlord takes responsibility for handling this.If you're in a rental now and if an appliance is not operating properly, notice leakage in your ceiling - contact your landlord.

No comments:

Post a Comment